What you can learn about Organisational Risk Culture from the CBA Prudential Inquiry

R2A was recently commissioned to complete a desktop risk documentation review in the context of the CBA Prudential Inquiry of 2018. The review has provided a framework for boards across all sectors to consider the strength of their risk culture. This has been bolstered by the revelations from The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Specifically, R2A was asked to provide commentary on the following:

- Overall impressions of the risk culture based on the documentation.

- To what extent the documents indicate that the organisation uses organisational culture as a risk tool.

- Any obvious flaws, omissions or areas for improvement

- Other areas of focus (or questions) suggested for interviews with directors, executives and managers as part of an organisational survey.

What are the elements of good organisational risk culture?

Organisations with a mature risk culture have a good understanding of risk processes and interactions. In psychologist James Reason’s terms[1], these organisations tend towards a generative risk culture shown in James Reason’ s table of safety risk culture below.

| Pathological culture | Bureaucratic culture | Generative culture |

|

|

|

How different organisational cultures handle safety information

Key attributes include:

- Risk management should be embedded into everyday activities and be everyone’s responsibility with the Board actively involved in setting the risk framework and approving all risk policy. Organisations with a good risk culture have a strong interaction throughout the entire organisation from the Board and Executive Management levels right through to the customer interface.

- The organisation has a formal test of risk ‘completeness’ to ensure that no credible critical risk issue has been overlooked. To achieve this, R2A typically use a military intelligence threat and vulnerability technique. The central concept is to define the organisation’s critical success outcomes (CSOs). Threats to those success outcomes are subsequently identified and are then systematically matched against the outcomes to identify critical vulnerabilities. Only the assessed vulnerabilities then have control efforts directed at them. This prevents the misapplication of resources to something that was really only a threat and not a vulnerability.

- Risk decision making is done using a due diligence approach. This means ensuring that all reasonable practicable precautions are in place to provide confidence that no critical organisational vulnerabilities remain. Due diligence is demonstrated based on the balance of the significance of the risk vs the effort required to achieve it (the common law balance). This is consistent with the due diligence provisions of the Corporations, Safety (OHS/WHS) and environmental legislation.

Risk frameworks and characterisation systems such as the popular 5x5 risk matrix (heat map) approach are good reporting tools to present information and should be used to support the risk management feedback process. Organisations should specifically avoid using ‘heatmaps’ as decision making tool as that is inconsistent with fiduciary, safety and environmental legislative requirements.

Risk Appetite Statements for commercial organisations have become very fashionable. The statement addresses the key risk areas for the business and usually considers both the possibility of risk and reward. However, for some elements such as compliance (zero tolerance) and safety (zero harm), risk appetite may be less appropriate as the consequences of failure are so high that there is simply no appetite for it. For this reason, R2A prefers the term risk position statements rather than risk appetite statements.

To get a feel for the risk culture within an organisation, R2A suggest conducting generative interviews with recognised organisational ‘good’ players rather than conducting an audit.

We consider generative interviews to be a top-down enquiry and judgement of unique organisations rather than a bottom-up audit for deficiencies and castigation of variations for like organisations. R2A believes that the objective is to delve sufficiently until evidence to sustain a judgement is transparently available to those who are concerned. (Enquiries should be positive and indicate future directions whereas audits are usually negative and suggest what ought not to be done).

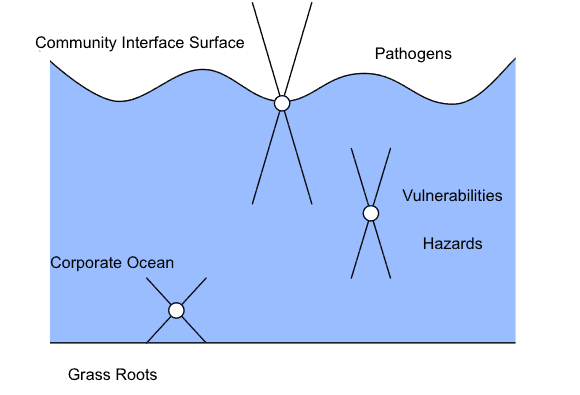

Interview depth

Individuals have different levels of responsibility in any organisation. For example, some are firmly grounded with direct responsibility for service to members. Others work at the community interface surface with responsibilities that extend deep into the organisation as well as high into the community. We understand that the idea is that a team interviews recognised 'good players' at each level of the organisation. If a commonality of problems and, more particularly, solutions are identified consistently from individuals at all levels, then adopting such solutions would be fast, reliable and very, very desirable.

Other positive feedback loops may be created too. The process should be stimulating, educational and constructive. Good ideas from other parts of the organisation ought to be explained and views as to the desirability of implementation in other places sought.

If a health check on your organsational risk culture or a high level review of your enterprise risk management system is of interest, please give us a call to discuss further on 1300 772 333 or head to our contact page and fill in an enquiry.

[1] Reason, J., 1997. Managing the Risks of Organisational Accidents. Aldershot, Hants, England: Ashgate Publishing Limited. Page 38.

Managing Critical Risk Issues: Synthesising Liability Management with the Risk Management Standard

The importance of organisations managing critical risk issues has been highlighted recently with the opening hearings of the coronial inquest into the 2016 Dreamworld Thunder River Rapids ride tragedy that killed four people.

In a volatile world, boards and management fret that some critical risk issues are neither identified nor managed effectively, creating organisational disharmony and personal liabilities for senior decision makers.

The obligations of WHS – OHS precaution based legislation conflict with the hazard based Risk Management Standard (ISO 31000) that most corporates and governments in Australia mandate. This is creating very serious confusion, particularly with the understanding of economic regulators.

The table below summarises the two approaches.

| Precaution-based Due Diligence (SFAIRP) | ≠ | Hazard-based Risk Management (ALARP) | |

| Precaution focussed by testing all practicableprecautions for reasonableness. | Hazard focussed by comparison to acceptable ortolerable target levels of risk. | ||

| Establish the context

Risk assessment (precaution based): Identify credible, critical issues Identify precautionary options Risk-effort balance evaluation Risk action (treatment) |

Establish the context Risk assessment (hazard based): (Hazard) risk identification (Hazard) risk analysis (Hazard) risk evaluation Risk treatment |

||

| Criticality driven. Normal interpretation ofWHS (OHS) legislation & common law |

Risk (likelihood and consequence) driven Usual interpretation of AS/NZS ISO 31000[1] |

||

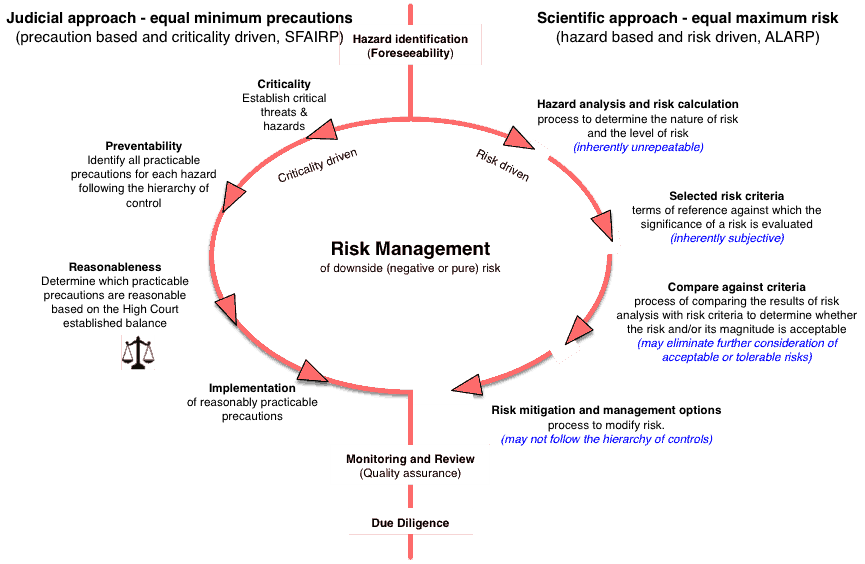

A paradigm shift from hazard to precaution based risk assessment

Decision making using the hazard based approach has never satisfied common law judicial scrutiny. The diagram below shows the difference between the two approaches. The left hand side of the loop describes the legal approach which results in risk being eliminated or minimised so far as is reasonably practicable (SFAIRP) such as described in the model WHS legislation.

Its purpose is to demonstrate that all reasonable practicable precautions are in place by firstly identifying all possible practicable precautions and then testing which are reasonableness in the circumstances using relevant case law.

The level of risk resulting from this process might be as low as reasonably practicable (ALARP) but that’s not the test that’s applied by the courts after the event. The courts test for the level of precautions, not the level of risk. The SFAIRP concept embodies this outcome.

The target risk approach, shown on the right hand side, attempts to demonstrate that an acceptable risk level associated with the hazard has been achieved, often described as as low as reasonably practicable or ALARP. But there are major difficulties with each step of this approach as noted in blue.

SFAIRP v ALARP

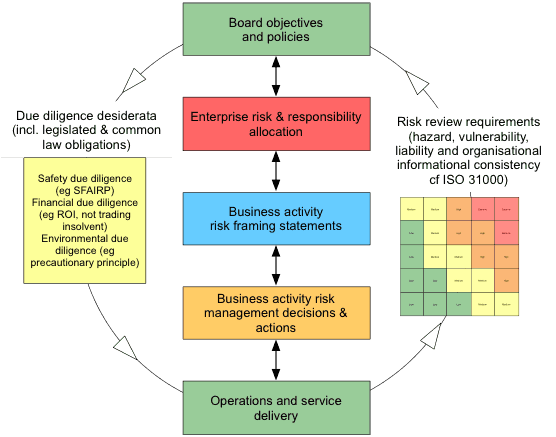

However, there is a way forward that usefully synthesises the two approaches, thereby retaining the existing ISO 31000 reporting structure whilst ensuring a defensible decision making process.

Essentially, high consequence, low likelihood risk decisions are based on due diligence (for example, SFAIRP, ROI, not trading whilst insolvent and the precautionary principle, consistent with the decisions of the High Court of Australia) whilst risk reporting is done via the Risk Management Standard using risk levels, heat maps and the like. This also resolves the tension between the use of the concepts of ‘risk appetite’ (very useful for commercial decisions) and ‘zero harm’ (meaning no appetite for inadvertent deaths).

Essentially the approach threads the work completed (often) in silos by field / project staff into a consolidated framework for boards and executive management.

If you'd like to discuss how we can assist with identifying and managing critical risk issues within your organisation, we'd love to hear from you. Head to our contact page to organise a friendly chat.

[1] From the definition in AS/NZS ISO 31000: 2.24 risk evaluation process of comparing the results of risk analysis (2.21) with risk criteria (2.22) to determine whether the risk (2.1) and/or its magnitude is acceptable or tolerable.